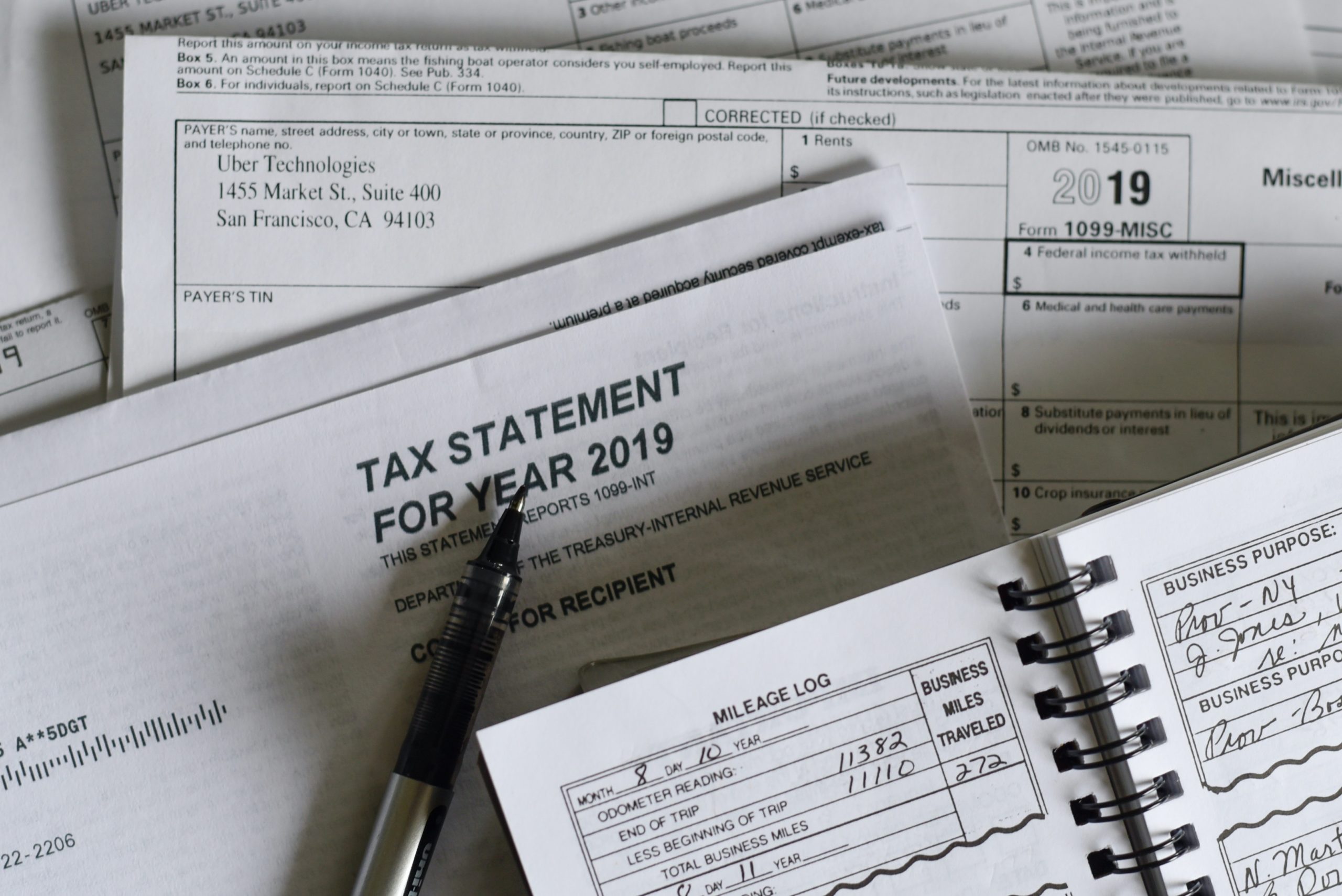

How to File Taxes As An Independent Contractor

Being an Independent contractor or consultant can be very fulfilling as the job comes with the lifestyle of freedom but accountability. Here are some things to keep an eye when filing taxes as an independent contractor during the upcoming tax year.

You have to know what you can expense.

Being an Independent Contractor provides you with many opportunities to save money on taxes, but what you can expense will depend on the nature of your business and must match your operating income.

A significant expense will be the portion of your home office used. You can expense a percentage of your mortgage interest or rent along with utilities related to the home office.

If you are an Independent Contractor but work at the client’s site for the majority of your workweek, then you cannot claim home office expenses.

Keep two bank accounts to save for taxes.

The change from employee to Independent Contractor is a great change but be wary of taxes owing for HST/GST and Taxes on Net Income. You should plan to save a portion of all sales into a second savings account for tax time.

Criteria for Self-Employed

Canadian Tax law is grey on this area but to be considered self-employed, you should:

- You must retain control of your schedule and work hours.

- Provide office supplies, computers or other tools required to complete your job.

- Have to claims to lost wages based on your contract.

One thing to maintain is that in your employment contract it states the above and that you are an independent contractor and not an employee. You are responsible for your job-related expenses and taxes.

At Chartered Professional Accountants, our specialized knowledge of working with self-employed contractors and small businesses that we can help create and maintain the necessary paperwork for monthly income and expenses for tax preparation and submission. Our consultants in Toronto help you understand the process of filing taxes as an independent contractor. Contact our team of professional accountants today.