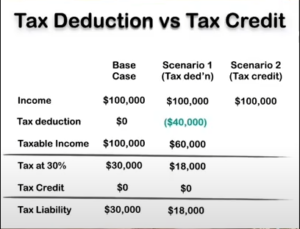

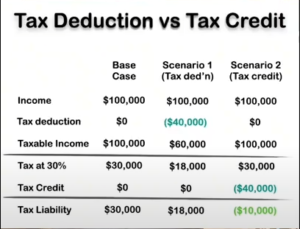

Tax Deduction vs Tax Credit

Many individuals are often confused on the exact differences between a tax deduction versus a tax credit. Simply put, a tax deduction reduces your taxable income whereas a tax credit reduces your tax liability dollar for dollar.

An example would be if you have $100,000 in taxable income and your average tax rate is 30%, a tax deduction of $40,000 thousand dollars would reduce your taxable income to $60 000 and your tax liability from $30,000 to $18,000.

In a scenario with a tax credit of $40,000, your tax liability will be reduced from $30,000 to -$10,000. Meaning you will receive a $10,000 tax refund if that tax refund is a refundable tax credit.

As you can see when a tax deduction and a tax credit are similar, then the tax credit will incur a greater tax break.